Policybazaar Insurance Brokers Private Limited CIN. We will work with you to include any information or images that you wish.

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Where a document is to be signed by a person on behalf of more than one company that person has to sign the document separately in each capacity.

. A PET is treated as an exempt transfer while the donor is alive and so PETs will not give rise to a lifetime IHT charge. Fundnel SG is regulated by the Monetary Authority of Singapore MAS as the holder of a capital markets services licence for dealing in securities and as an exempt financial advisor in relation to securities and collective investment schemes in SingaporeHGX Pte. Similarly to the company car benefit if you offer free parking at the office inform employees how to manage their allocated space.

Some industries may have hourly employees who are exempt from overtime pay. Foreign fund management company 60. Any dividends distributed by the company will be exempt from tax in the hands of the shareholders.

PrivateWhite Label Tea Designs. Please forward application using companys letterhead to. About 53 of ECF issuers were technology-centric companies with business expansion cited as the main purpose for fundraising.

One directorshareholder companies are acceptable. Owners and directors not in public records. The ROC may exempt certain classes of companies from appointing an auditor.

On behalf of the company by a director of the company in the presence of a witness who attests the signature. Orientation and Training 2. Changes to the program included the minimum monthly.

B payment by cheque made payable to or to the order of the employee. Malaysia Company Incorporation Services. On 4 August 2017 the ROC issued Practice Directive 32007 exempting three categories of private companies namely dormant companies zero.

Investment holding company listed on Bursa Malaysia 60 G. Immigration Law Applicable to All Employees 2. High resolution images of your finished tea cans are available at 20 per.

Company exempt from paying taxes even if new tax laws are imposed over the next 20 years. Companies that are indulged in biotechnology related activities and have an approval as Bionexus Status Company from the Biotechnology Coporation Sdn Bhd Malaysia are eligible. After the Malaysian government suspended the MM2H program suddenly in July 2020 Malaysias Home Ministry Secretary-General reopened the program in October 2021.

Hours of Work 2. Labuan companies enjoy tax advantages with a tax rate of 3 on audited net profits for companies that carry out trading activities and 0 for companies that carry out non-trading activities. Dress Code and Public Image 2.

Attendance and Punctuality 2. Flex Time and Telecommuting 2. Is regulated by the MAS as a recognised market operator.

Risk Warning Disclaimers Fundnel Pte. As mentioned above foreign-sourced income received in Malaysia by a resident company is exempt from tax unless the recipient carries on the business of banking insurance shipping or air transport. Pengarah Lembaga Hasil Dalam Negeri Malaysia Jabatan Pungutan Hasil Aras 15 Menara Hasil Persiaran Rimba Permai Cyber 8 Peti Surat 11833 63000 Cyberjaya Selangor Darul Ehsan Attn.

The then Government of Malaysia tabled the first reading of the Bill to repeal GST in Parliament on 31 July 2018. Foreigners can own 100 of an exempt company. A payment into an account at a bank or a finance company licensed under the Banking and Financial Institutions Act 1989 in any part of Malaysia being an account in the name of the employee or an account in the name of the employee jointly with one or more other persons.

For a private company it must be done within 30 days from the day the accounts are circulated to the members s2591a. If the donor dies within seven years an IHT charge will arise and tax will be payable by the donee. Failure to properly distinguish exempt from non-exempt employees sometimes referred to as misclassification can adversely affect businesses.

If you offer company cars as a benefit make sure to inform employees how you expect them to behave when using the car and which expenses youll compensate eg. A PET becomes an exempt transfer if the donor survives for seven years from the date of the gift. 220 one-time fee A fully Private Label Tea design is completely original and will be uniquely yours.

The 6 tax will replace a sales-and-service tax of between 515. U74999HR2014PTC053454 Registered Office - Plot No119 Sector - 44 Gurgaon - 122001 Haryana Tel no. Malaysias state-owned oil company.

Gas and tolls Parking. Takaful business 60 AB. On behalf of the company by at least 2 directors of the company.

The more notable examples include the agriculture movie theater and railroad businesses. Last Updated May 18 2022. Tolled Highways or Bridges.

In 2021 some RM2216 million was raised by 104 issuers through as many campaigns representing a 735 y-o-y jump 2020. However the non-deductibility of costs attributable to foreign-sourced income should be considered. Bahagian Pemodenan Sistem Pengutan BPSP or email to.

Chargeable income reduced rate and exempt dividend 60 AA. Chargeable income of life fund subject to tax 60 B. Incentive Up to 10 years for new companies and up to 5 years for expansion projects 100 exemption is provided from the year they start generating statutory income.

If the US Company owns at least 10 of the voting stock of a company which is a resident of India and the US Company receives dividends then the income tax received by the Indian Government from the Indian company with respect to the profits from which dividends are paid shall be allowed as a credit. As a full-fledged and pure-play Islamic bank Bank Islam provides banking and financial solutions that strictly adhere to the Shariah rules and principles and are committed to the ideals of sustainable prosperity and ESG. We can match your current branding or design something new.

Established in July 1983 as Malaysias first Islamic Bank Bank Islam has 141 branches and more than 900 self-service terminals nationwide. Singapore Exempt Private Company EPC. This is because Malaysias luxury real estate industry relies heavily on foreign investors.

A Labuan trading company is a company established in Labuan Malaysia that carries on certain Labuan trading or non-trading activities. Domestic private or capital expenditure The Company can claim capital allowance for capital expenditure incurred. Tax-neutral reorganizations or mergers.

Banking business 60 D. Investment holding company 60 FA.

Ccm Issues Practice Directive On Audit Exemptions For Private Companies Zico

Exit From Canada Business Tax Canada

Uk Visa Application Fees From Russia 2019 20 Uk Visa Visa Application

Exit From Canada Business Tax Canada

St Partners Plt Chartered Accountants Malaysia Ssm Effective From 1st February 2019 It Will Be Mandatory For Companies In Perlis Perak Kedah And Penang To Submit Below Documents Via The

Vivo Releases Android 13 Developer Preview Program For Vivo X80 And X80 Pro

New Eu 2021 Vat Rules For Ecommerce Updates

Aaron Takeda Senior Client Success Manager Exempt Edge Linkedin

Can New Covid 19 Testing Reqs For Inbound Travellers Kpmg Global

Ontario Temporarily Exempts Corporate Annual Returns Kpmg Canada

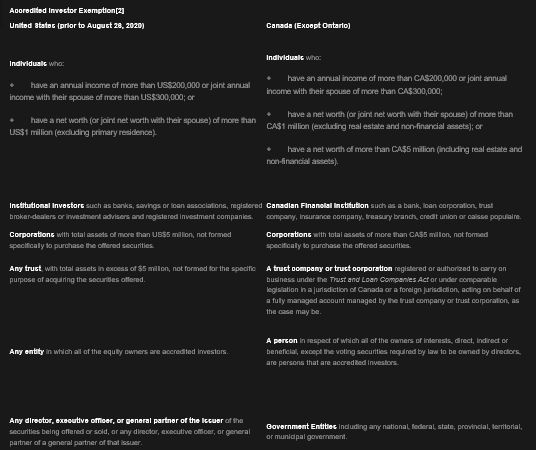

Now In Effect Expanded Us Accredited Investor Exemption Securities Canada

Aaron Takeda Senior Client Success Manager Exempt Edge Linkedin

The Difference Between A Private Company And An Exempt Private Company

Labour Market Impact Assessment Lmia Canadianvisa Org

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

Starting An Exempt Private Company In Singapore Benefits And Process Singaporelegaladvice Com

Exempt Private Company Epc And Its Directors Responsibilities Corporate Services In Malaysia Corporate Advisory Corporate Recovery Restructuring Company Secretary

The Difference Between A Private Company And An Exempt Private Company